Every time crypto investors try to find a way or method to generate more profit from the crypto world, they will sometimes end up in the world of Defi (Decentralized Finance). The Defi movement had undoubtedly caused a change in investing culture and probably contributed to the rise of the crypto market and NFTs projects in 2021. Moreover, this movement has generated profit for countless crypto investors, and “To the Moon” was coined.

During this period of the crypto market downturn, war, poor economy, and inflation. As a result, each cryptocurrency’s value dropped dramatically, which can also be called “The Red Battlefield,” where the entire trading board turned red. Moreover, the trend of investing in Defi projects has also decreased, instigating crypto investors to question whether Defi projects still hold the credibility to achieve profitability amid this crypto market downturn. Or perhaps, Defi projects are just a hoax?

In this article, we will discuss whether Defi projects are still worth investing in during this period of the crypto market downturn and the latest situation in each project.

What is Decentralized Finance?

Decentralized Finance or Defi is a source of intermediary financial transactions in the world of crypto-currency financial networks. The most explicit feature of Defi is that there is no intermediary to control or coordinate financial transactions between service providers and users. This makes transactions run faster and eliminates unnecessary steps compared to our current financial system with intermediaries (Centralize Finance) such as credit guarantees, banks, exchanges, cooperatives, etc.

Many skeptical may wonder, “If there is no intermediary, then how will transactions be moderated for service users?”. The answer is to use Smart Contracts to act as an intermediary. Each Defi platform created Smart Contracts to support and carry out fast transactions, allowing people who use Defi to verify transactions more transparently and complete payments in a trustless fashion and, the best part, without any third-party involvement.

So, what can DeFi change?

Loaning

When we think of Centralize Finance, we will think of financial institutions where they will ask for your personal history, do a credit bureau and payment history check on you, etc. These inspections are done accordingly to the procedures depending on each financial institution. Therefore, it is a lengthy procedure and will take quite a long time to review and approve.

Defi eliminates the use of an intermediary. Hence the staff that coordinates transactions of any financial institutions will not be necessary. The procedures mentioned above will be simplified and unnecessary steps will be erased. Loaning and borrowing procedures will be faster, and if you play by the rules, no one in the world can stop or freeze your transactions. To execute this, the Defi platform must be on a crypto network.

The Current Situation of Defi Projects

Compound

Compound is one of the projects known for borrowing cryptocurrencies and the first to do so since Ethereum implemented Smart Contract on its network. By comparing the past 90 days of TVL values from April 2022 to July 2022, the value has fallen by $2.56 billion from its original value of $6.42 billion. Moreover, the price of Comp coin from the actual price of $155.45 has also dropped to $49.44.

Aave

This is another well-known project for borrowing cryptocurrencies and was originally developed on the Ethereum network. It is also known to be very similar to Compound in terms of the right to vote when a project is in a state of change or modification. Hence the more AAVE investors have, the more votes they have. In the last 90 days, TVL’s value and Compounds’ token price have fallen to $8.5 billion from the original value of $11.83 billion. Furthermore, the price of the AAVE coin, from the original price of $197.07, has dropped to $68.20.

Currency Exchanges

Regarding exchanging currencies, exchanges act as agents for converting foreign currency from one currency to another. The main workflow of exchanges is to monitor the value of a foreign currency compared to the local currency at the time of service, in which exchanges will need to be paid at full price plus service fees.

However, if it’s Defi, even though it has a similar working principle, the difference is that Defi does not need to have a hefty service fee or a trusted third party to mediate. Instead, it will be done by using Smart Contracts, where users can exchange one cryptocurrency for another. The entity controlling the tokens’ value and price in the Liquidity Pool is called “AMM” (Automated Market Marker). They will calculate how much the user exchanges crypto coins from A to B. AMM will pay the provider and forward it to the Smart Contracts automatically without a trusted third-party getting involved.

For this reason, people in the cryptocurrency community will refer to this as a Decentralize Exchange or a DEX. The most obvious example is MakerDAO, Pancakeswap, Uniswap, Sushiswap, etc.

Currency Exchange and the Current Situation

Uniswap

The world’s first DEX, developed on the Ethereum network, has published the AMM’s behind-the-scenes workflow that controls the price of coins and tokens. Thus, causing this project to become popular for the exchange of currencies without intermediaries. The TVL’s value in the past 90 days has dropped from $2.87 billion to $1.60 billion. The value of the Uniswap token has also dropped from $9.80 to $5.57.

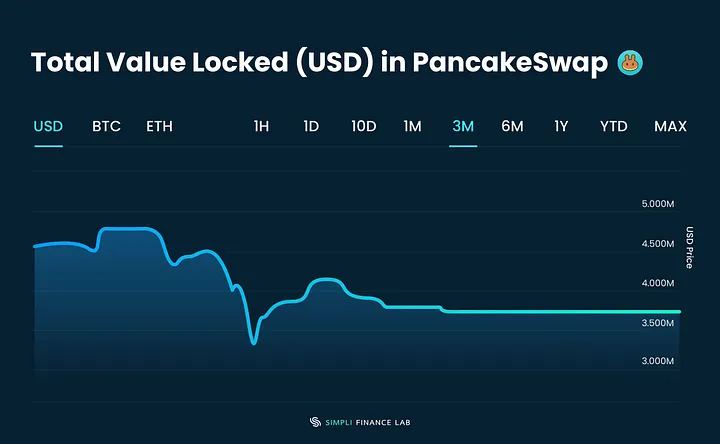

PancakeSwap

Pancake swap is another popular Defi project on the Binance Smart Chain (BSC: BEP-20) that allows trustless token swapping. This will enable developers of individual projects to build a Defi source just like Ethereum, with the advantages of lower fees and faster transactions than Ethereum. Like Uniswap, you can also generate passive income by doing Yield Farming.

From the latest situation, the TVL’s value in the last 90 days has fallen dramatically from $5.15 billion to $3.78 billion. Furthermore, the value of the Cake token has also fallen from $9.65 to $2.93.

In conclusion, is DeFi still worth investing in?

The TVL in each Defi project has been reduced. However, it does not mean that the Defi projects are unprofitable or a scam. As long as people use Defi for its financial transaction services, whether it’s exchanging or borrowing, Defi projects will still be around, which is the case right now.

A critical aspect that investors or users on Defi projects tend to consider is the value of Defi Tokens that could be earned as a result of investing in a Defi project through IDO, allocations, airdrop, or any other method. Initially, when the value of the token decreases, it will seem like the project has failed, but in reality, the survival or failure of a Defi project does not depend on the value of the Defi token but the number of people using it.

Therefore, before investing in any Defi project, you should study the details through the whitepaper and the roadmap. Be mindful and consider the risks before deciding, in order to prevent negative returns on investments.