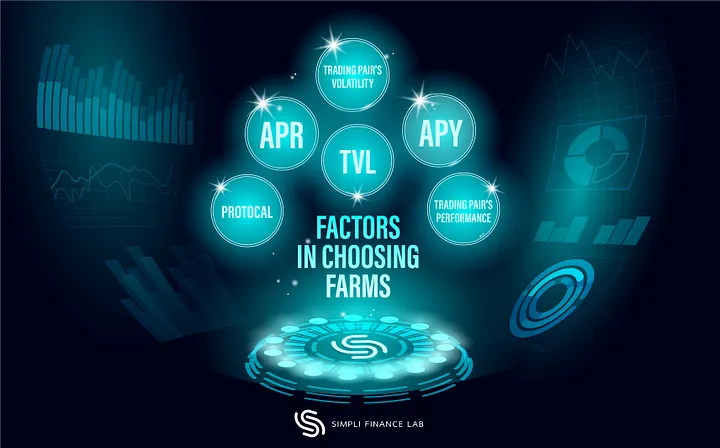

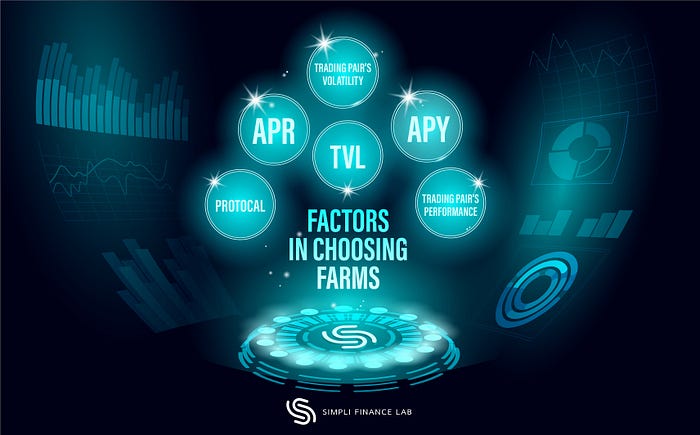

Yield farming is the hottest and one of the most attractive functions in the DeFi world. It has the charm of “easy money” and pulled many investors into this gold rush. However, is it truly ‘easy money?’ More experienced DeFi investors might disagree with that statement. Sure, investors can check the farms’ APR (Annual Percentage Rate) on the protocol’s website to see the promising profit percentage. Then, check the TVL (Total Value Locked) to evaluate the reliability of the farm. But are those all the techniques to the successful and profit maximized yield farming?

A dangerous underlying point of yield farming is impermanent loss. Impermanent loss is when the liquidity provider loses the value of the farm through the volatility of the trading pairs’ values. Impermanent loss is hard to deal with on the scale of self-investing due to the volatile nature of cryptocurrency and the overwhelming data. There are so many data points on the performance of each cryptocurrency in a span of time. These data are nearly impossible to analyze and conclude each cryptocurrency’s risk and return level without guessing or illusions. Therefore, choosing farms to invest in is sometimes not as easy as it seems.

SIMPLI is an artificial intelligence-based investing assistant that can analyze all of the data of all trading pairs through quantitative methods. SIMPLI will evaluate the best trading pairs and protocols customized to your risk preference. With the help of an assistant like SIMPLI, you can rest assure to be recommended the best decision from a thorough bias-free analysis of return level, risk level, reliability of protocol, and the stability of the currencies.

About Us:

Simpli Finance Lab is a Decentralized Financial (DeFi) research lab that pioneers in applying AI and Machine Learning to the Defi ecosystem. In the past few years, transactions on the blockchain through smart contracts have led to a new age of Big Data, where data is cheaply available, verifiable, and highly unified. In the traditional world of finance, a large quantity of quality data is a gold mine where businesses can utilize to supercharge their business. However, the space of quantitative modeling has been extremely competitive and has a high barrier of entry for a normal user. Hence the only benefiter of big financial data have been large financial institutions. We believe that the power of Big Data, AI and Machine Learning can build a better and fairer financial system for all in the years to come. Simpli Finance Lab will launch a series of AI-enhanced DeFi Products that allow users to have a competitive edge in the long run.

Visit our website or follow us on Twitter for more details and get latest updated.

7