What is impermanent loss?

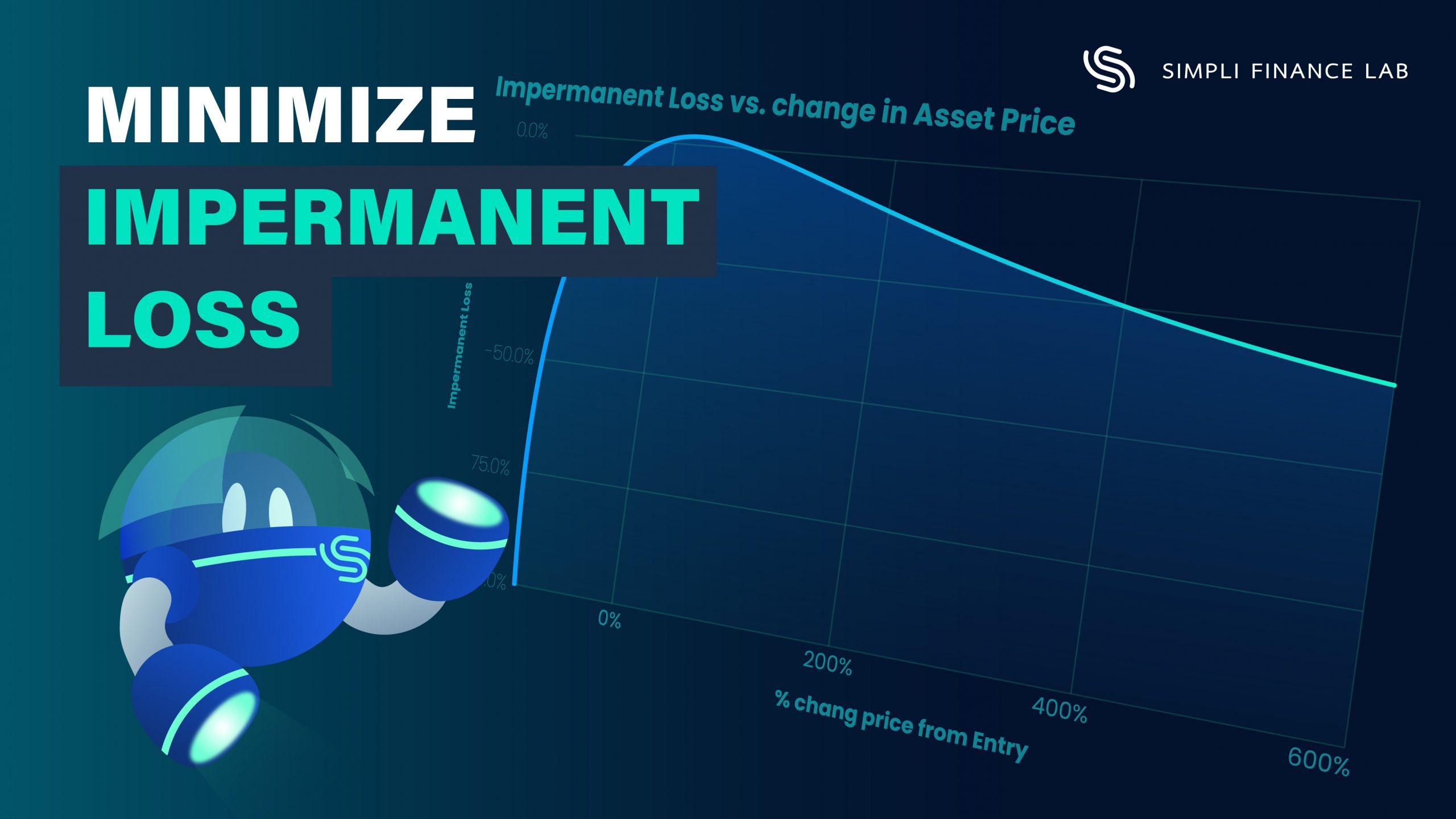

Anytime you provide liquidity to a pool on pancakeswap or uniswap, you risk experiencing what’s known as impermanent loss. This happens whenever the ratio of assets in the pool changes, i.e. there’s a change in price: the greater the change, the greater the amount of impermanent loss. Now “impermanent loss” is a bit of a misnomer, since technically you’re not really losing anything, it’s just that the value of the assets you get back after removing liquidity is going to be lower than if you were to just HODL the assets in the first place.

We’re not going to dive too deep into the technicalities of impermanent loss here, if you’d like to learn more we’d like to point you to this brilliant article: https://academy.binance.com/en/articles/impermanent-loss-explained. If you’d just like to calculate how much impermanent loss you’re going to receive you can use this calculator: https://dailydefi.org/tools/impermanent-loss-calculator/.

How do you minimize impermanent loss?

The easiest way to avoid impermanent loss is to simply choose a pool that is stable in price. For example, USDT/BUSD is probably going to a pool that will have almost no impermanent loss, since they’re both stablecoins. However, the rewards from this pool will most likely be lower than some of the more risky pools, and who doesn’t want some excitement in their lives?

The thing about minimizing impermanent loss is, it’s not so much trying to actually minimize it, but more so making sure that the rewards you receive will more than compensate you for any impermanent loss. Doing this yourself can be tedious: it’s not just looking at the APR, which is changing all the time, but estimating impermanent loss, changes in price, etc.

This is all part of the reason we made Simpli Finance, to free you of this gruelling process. Simpli Finance will automatically give you the best returns for your level of risk, taking into account governance token rewards, impermanent loss, and asset prices. Why encumber yourself with tedious calculations and estimations when this can all be done so Simpli.

About Us:

Simpli Finance Lab is a Decentralized Financial (DeFi) research lab that pioneers in applying AI and Machine Learning to the Defi ecosystem. In the past few years, transactions on the blockchain through smart contracts have led to a new age of Big Data, where data is cheaply available, verifiable, and highly unified. In the traditional world of finance, a large quantity of quality data is a gold mine where businesses can utilize to supercharge their business. However, the space of quantitative modeling has been extremely competitive and has a high barrier of entry for a normal user. Hence the only benefiter of big financial data have been large financial institutions. We believe that the power of Big Data, AI and Machine Learning can build a better and fairer financial system for all in the years to come. Simpli Finance Lab will launch a series of AI-enhanced DeFi Products that allow users to have a competitive edge in the long run.

Visit our website or follow us on Twitter for more details and to get the latest updates.

Join Our Telegram: https://t.me/SimpliFinanceLab_CH