First of all we hope you had a great new year! In the pass few weeks the team have been BUIDLING tirelessly to finalize our product as we get ready for the mainnet launch. We’ve invested our time in improving:

- User experience

- Smart contracts

- Data collection of more farms

- Security audit

- Research and development

In this article we’ll go through some key improvements that are necessary for us to launch strong on the mainnet. We hope you are as excited as we are! 🚀

User Experience

While we were finalizing the product on the testnet, we found that by the nature of the smart contract, we would be asking the user to Approve the transaction too many times to get their funds to where they intend to be. This would strongly worsen the user experience, and hamper our mission to make Defi as smart and simple as possible.

For instance, if N is the number of target farms, we found that the user may be required to Approve their transactions (e.g. on Metamask) up to 1+10N times. Farming at 5 different farms, and withdrawing their funds, would demand the user to click up to 51 Approves on their Metamask! We’ve invested in our time to fully solve this issue at the smart contract level. This will allow us to scale to however many farms we’d like in the future.

Smart Contracts

- Staking: if you aren’t aware, our token staking is live on mainnet. You can now stake your tokens here. When the farm goes live, part of the yields compounded regularly will be used to buy back $SIMPLI and re-distributed to Simpli stakers

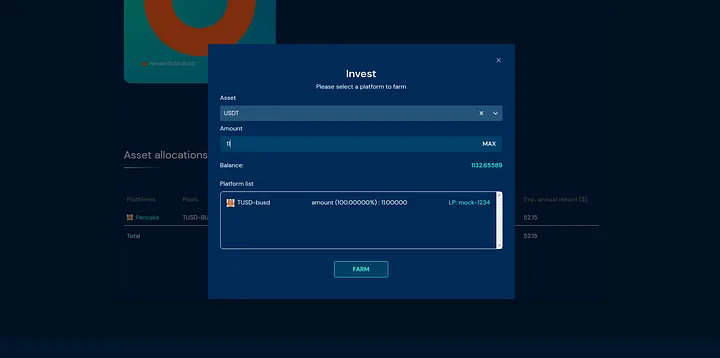

- Broker: we’ve implemented a single touch point where it does all the swapping and farming for you — we call this our Broker. The Broker solves the problem of users having to click approve multiple times to get their funds in/out of the farms

- Zap: this contract allows you to deposit any BEP20 tokens or BNB and get target LP tokens. We’ve refactored this to work properly with the Broker. Now users can easily farm directly from a single token (e.g. USDT, BUSD, BNB), and they can withdraw all funds into one single token of their choice

- Strategies: we’ve refactored the code considerably to improve the tokenomics of $SIMPLI. When the farm auto-compounds, part of the yield will be used to 1) buy back and providing LP for SIMPLI/WBNB, and 2) buy back $SIMPLI to be re-distributed as staking rewards. This will introduce more buying pressure of $SIMPLI while reducing the supply as the network grows, and also increase the liquidity of the AMM for larger trades.

All of this is to improve the user experience and tokenomics.

Data Collection of Farms

Because of the risk from long-tail smaller caps, we’ve decided to start with a small, carefully selected set of farms. We have a mechanism to check the yields and prices across different data sources, allowing us to have the most updated yield profile of our assets. Currently we have productionized the data collection for 8 farms that will be our investable assets for the initial mainnet launch. We’ll continue to add more farms and make the farmable universe more diverse. For this we perform a careful selection and screening for those platforms/assets that are reputable, have great fundamentals, and importantly have a lower chance of rug-pulling.

Security Audit

Our smart contracts are currently being audited by Inspex. Security of your funds is our top priority.

Research and Development

Our ambition to be the leading data-driven farm in Defi has just begun. We have started to research ways we could utilize various Deep Learning methods — particularly Graph Neural Networks — to look for patterns on-chain and predict the direction of the market. We are constantly recruiting great talents to work in the space. If you are a great Data Scientist and are interested in what we’re doing, let’s chat!

Upcoming Features for 2022

- More farms and chains **** 👩🌾

- Improved AI Models 🤖

- Auto portfolio rebalancing 📈

- And much more… stay tuned! 👀

About Simpli

Simpli Finance is a yield aggregator that uses Artificial Intelligence to help optimize yield farming. DeFi as an industry is growing exponentially, and it is getting harder for investors to keep track of new farms, let alone coming up with their investment strategies. Simpli Finance aims to solve this problem by having a portfolio optimizer based on data such as historical price, volume, other derived technical features, and on-chain data. The team plans to use this to outperform the market and make the investment strategy easily accessible to yield farmers in DeFi.

Links

Coinmarketcap: https://coinmarketcap.com/currencies/simpli-finance/

Coingecko: https://www.coingecko.com/en/coins/simpli-finance

Buy Simpli: https://pancakeswap.finance/swap?outputCurrency=0x71f69afed8825d6d9300ba4d74103e1dcc263b93

Twitter: https://twitter.com/simpli_lab

Telegram: https://t.me/SimpliFinanceLab_CH